SAP Joule and Agent-Driven Composable Banking: The New Operating System for Banks

In 2025, retail and commercial banks stand at a crossroads: innovate at scale, or risk irrelevance. According to Boston Consulting Group, up to 50% of banks could disappear by 2030 if they fail to adapt to the era of fluid revenue streams and technology-driven cost implosion. The need for agility, personalization, and composability in financial services has never been more urgent. Enter SAP Joule, SAP’s generative AI agent, and a game-changer in how banks reimagine processes, products, and platforms.

But the key to unlocking Joule’s full potential? Data. Clean, harmonized, and accessible.

From Monolithic Cores to Composable Intelligence

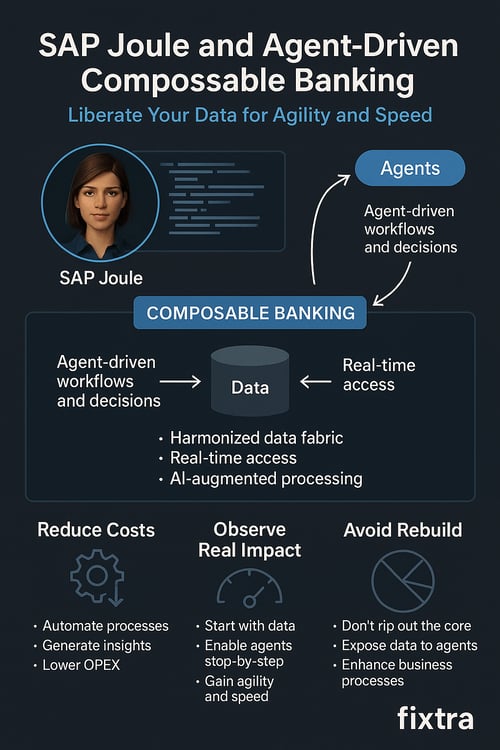

Traditional banking infrastructures—built around rigid core systems—are being outpaced by customer expectations. New banking paradigms are emerging: Composable Banking, where capabilities are modular, API-driven, and agile. At the heart of this shift is the agent model, exemplified by SAP Joule: an intelligent layer that dynamically orchestrates user interactions, processes, and decisions.

SAP Fioneer’s Transactional Banking (TRBK) platform already reflects this shift. It is modular, event-driven, and AI-augmented, offering a foundation upon which intelligent agents can operate at scale. But composability without intelligence is not enough. That’s where Joule enters the stage.

SAP Joule: Beyond Chatbots—A Strategic AI Agent

Unlike conventional bots, SAP Joule isn’t a single-purpose assistant. It’s a domain-specific, contextual AI agent that integrates directly into SAP's business applications. It doesn’t just answer questions—it performs actions, summarizes complex documents, detects anomalies in subledger data, and initiates workflows.

When connected to SAP Fioneer platforms like FPSL (Financial Products Subledger) or FSDM (Financial Services Data Management), Joule can:

-

Simulate financial scenarios (e.g., IFRS 9 stage transfers, loan portfolio risk impacts)

-

Automate audit preparation by parsing accounting records across GAAPs

-

Empower users with no-code interfaces for data exploration and task execution

-

Reduce cost and complexity in back-office operations by replacing manual processes with AI-driven insight engines

Joule’s effectiveness hinges on access to high-quality, granular data—which is precisely what platforms like FPSL + FDS are designed to deliver.

Data: The Fuel for Agent Intelligence

Every AI agent is only as powerful as the data it's allowed to see. The Finance Data Suite (FDS) ensures that SAP Joule isn’t operating in a silo. With components like the Finance Open Integration Framework (FOF) and Financial Consumption Layer (FCL), FDS enables real-time integration, transformation, and lineage tracking of banking data—from contracts and transactions to behavioral patterns and ESG factors.

This harmonized, explainable data fabric allows Joule to make context-aware decisions and recommendations. It’s not just about finding answers—it's about understanding why an answer is correct, what it means for risk exposure or profitability, and how to act on it.

Real-World Application: Embedded Intelligence in Lending

Consider the Credit Workplace (CWP) by SAP Fioneer. It’s an origination and underwriting hub that banks already use to automate decisions. With Joule integrated, that workflow becomes intelligent:

-

Documents are parsed in seconds for entity-level risk factors

-

Portfolio forecasts are generated and simulated in real time

-

Extensions and renewals are prompted based on real-time liquidity patterns

This is no longer workflow automation. It’s decision intelligence embedded in day-to-day operations.

From Cost Cutting to Strategic Agility

Joule and composable banking together do more than reduce operating costs—they create strategic agility. A bank doesn’t need to rip and replace its core. Instead, it can expose modular data services, and let agents like Joule do the thinking, reasoning, and acting on top.

This approach enables:

-

Rapid product launches (e.g., BNPL, dynamic savings)

-

Micro-personalized experiences powered by behavioral triggers

-

Hyper-automation in compliance, risk, and finance

The result is a new operating model: agent-first banking, where processes are built for—and sometimes by—the agents.

Visionary Call to Action

The winners in banking’s next era will be those who see AI agents not as tools—but as platform citizens. To compete in a world of disappearing margins and fluid loyalty, banks must shift from human-dependent workflows to data-enabled, agent-driven ecosystems.

And the first step isn’t installing a bot. It’s unlocking your data.

At Fixtra, we help banks bridge vision and execution by combining the power of SAP BTP, SAP Joule, and agent-ready architectures like TRBK and FPSL. Whether you're just beginning your composability journey or scaling AI across your enterprise, Fixtra offers the strategic clarity, platform expertise, and hands-on delivery to make it real.

Composable. Intelligent. Scalable. This is the future of banking. Let’s build it together.