Composable Banking: How SAP BTP Redefines Financial Services in 2025

Building the Future of Finance, One Block at a Time

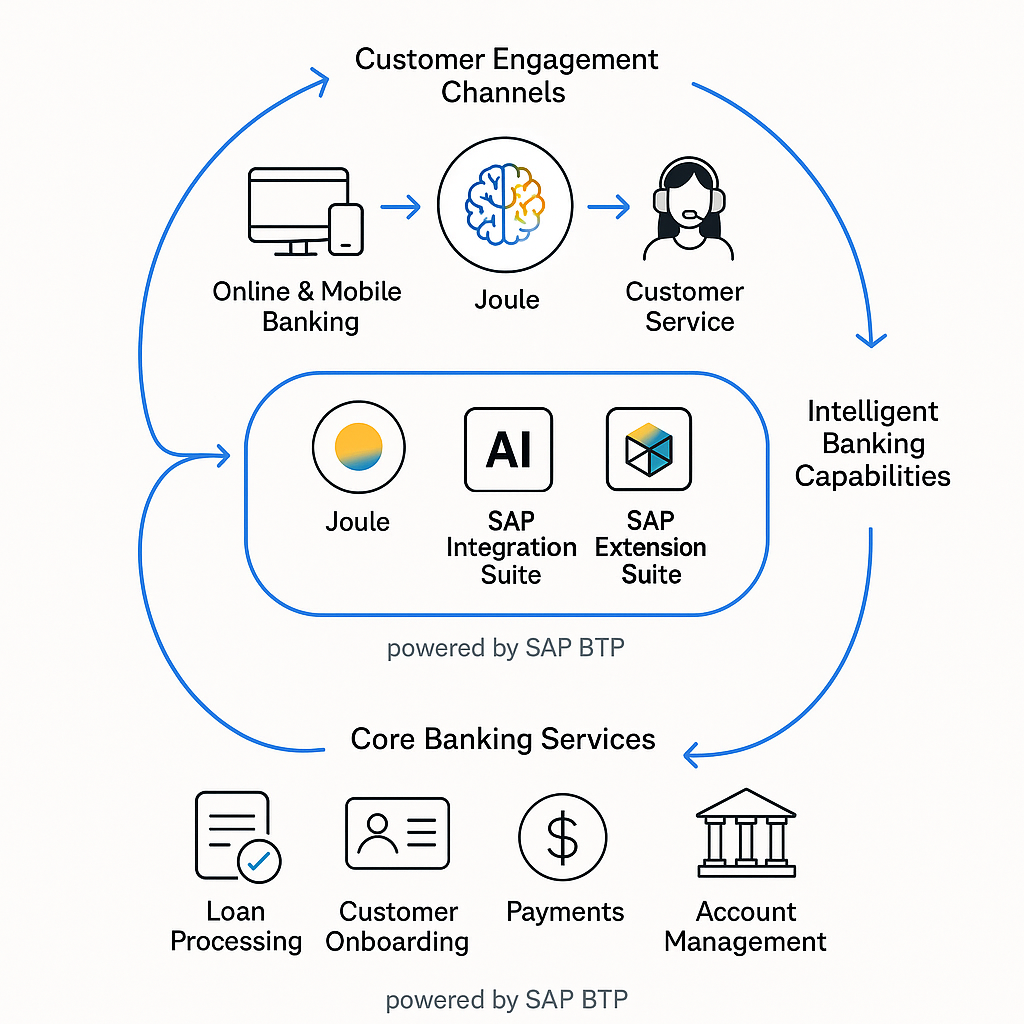

In 2025, the financial services industry faces unprecedented challenges and opportunities. Rapid technological advancements, evolving customer expectations, and stringent regulatory requirements demand agility and innovation. Enter composable banking—a modular approach that empowers institutions to assemble and reassemble banking components to meet specific business needs swiftly. At the heart of this transformation lies the SAP Business Technology Platform (SAP BTP), providing the tools and frameworks necessary to construct a flexible, scalable, and intelligent banking ecosystem.

Understanding Composable Banking

Composable banking refers to the design and delivery of financial services through interchangeable and reusable components. This approach allows banks to:

-

Accelerate innovation by integrating best-of-breed solutions.

-

Enhance customer experiences through personalized services.

-

Adapt quickly to market changes and regulatory demands.

-

Reduce costs by avoiding monolithic system overhauls.

By adopting composable architectures, banks can move away from rigid legacy systems towards agile platforms that support continuous improvement and scalability.

SAP BTP: The Engine Behind Composable Banking

SAP BTP serves as the foundational platform enabling composable banking by offering:

1. Integration Capabilities

With over 4,200 APIs and 250+ connectors, SAP BTP facilitates seamless integration between SAP and third-party applications, ensuring data consistency and process efficiency across the banking ecosystem.

2. Application Development and Automation

SAP BTP supports both low-code and pro-code development environments, allowing banks to rapidly build, deploy, and manage applications tailored to specific business functions. Tools like SAP Build enable the creation of user-centric applications without extensive coding knowledge.

3. Data Management and Analytics

The platform's robust data management capabilities, including SAP HANA Cloud and SAP Analytics Cloud, empower banks to harness real-time data for informed decision-making, risk assessment, and customer insights.

4. Artificial Intelligence and Machine Learning

SAP BTP integrates AI and ML services, such as SAP AI Core and SAP Joule, to automate processes, detect anomalies, and provide predictive analytics, enhancing operational efficiency and customer satisfaction.

Real-World Application: A Case Study

Consider a mid-sized bank aiming to improve its loan approval process. By leveraging SAP BTP's composable architecture:

-

Integration: Connects customer data from various sources for a comprehensive view.

-

Application Development: Develops a custom loan processing application using SAP Build.

-

Analytics: Utilizes SAP Analytics Cloud to assess credit risk and forecast loan performance.

-

AI/ML: Implements SAP AI Core to automate credit scoring and decision-making.

This composable approach results in faster loan approvals, reduced operational costs, and improved customer satisfaction.

The Future of Composable Banking with SAP BTP

As the financial landscape continues to evolve, composable banking, powered by SAP BTP, positions institutions to:

-

Innovate continuously by adopting emerging technologies.

-

Respond swiftly to regulatory changes and market demands.

-

Deliver personalized experiences that meet customer expectations.

-

Maintain a competitive edge in a dynamic industry.

Partnering for Success

At Fixtra, we empower banks to transform vision into reality by combining SAP BTP's capabilities with deep AI and financial services expertise. Our commitment is to guide institutions through the journey of composable banking, ensuring agility, innovation, and sustained growth in the digital era.

Meta Description: Discover how composable banking, enabled by SAP BTP, is revolutionizing financial services in 2025 through modular architectures, seamless integration, and intelligent automation.